Christmas is only two weeks away and there are those that still have not gotten any shopping done! Thank goodness for online shopping which can usually have last minute items shipped to you right before Christmas for an extra fee. The malls roll out the red carpet for last minute sales by having the stores open as early as 6 am. This is all well and good yet how will you shop for Christmas and make your budget stand up to the temptations of overspending?

First of all, holiday shopping does not have to be a chore. Sit down, write out a realistic budget and truly analyze what you will spend period. No excuses because you need to know where every dollar is going. Be sure to spend cash only and leave the credit cards at home.

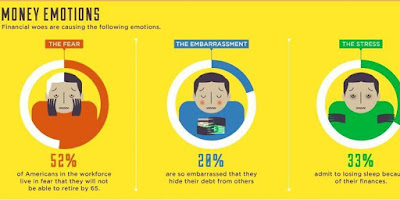

Secondly, be sure to spend with the right emotions. This is so important because most people spend because of guilt and sometimes validation. To go further, when spending because of guilt it is when you buy something for someone you truly do not like (a relative, a co-worker) just because of the season. The guilt has to be gone because it is not your true you and you will beat yourself up another year for doing it. As for validation, some people spend to be liked and in hopes of getting something real nice. No! This goes along with the guilt trip. Some people will spend on who they want and you may not be one of them. So if you insist upon giving, do not be surprised if the favor is not returned. Just make a mental note to not include them on your next year's list.

Third, when shopping, the temptation from sales people and seeing beautiful displays will beckon unto you. Step away from the displays and graciously, yet firmly say "No thank you" to the sales people. You see, they are trying to meet their quota of sales for the year. You, on the other hand want to stick to your budget and remain sane.

Fourth, as for any children involved, please do not overload them with stuff they will only play with a little and have it sitting in a corner (for instance, toys and games). Once the newness of the gifts wear off, you will wonder what lead you to spend so much money. Also, do not allow their whining (the neighbor's kid got lots of stuff) to sway you, YOU are the parents, period.

Lastly, you will be proud of yourself for sticking to your budget and not having to use your credit cards (because you will pay them off asap and cut the cards...js). Your Christmas will even be merrier as well as frugal.

To all of you, I wish you a very Merry Christmas and as always...

Stay Frugal and Proud!

Dot

ARTICLES AND SOURCES